By MICHAEL CRIMMINS

Glasgow News 1

The Kentucky bill that seeks to reduce the state’s income tax is now the law of the commonwealth.

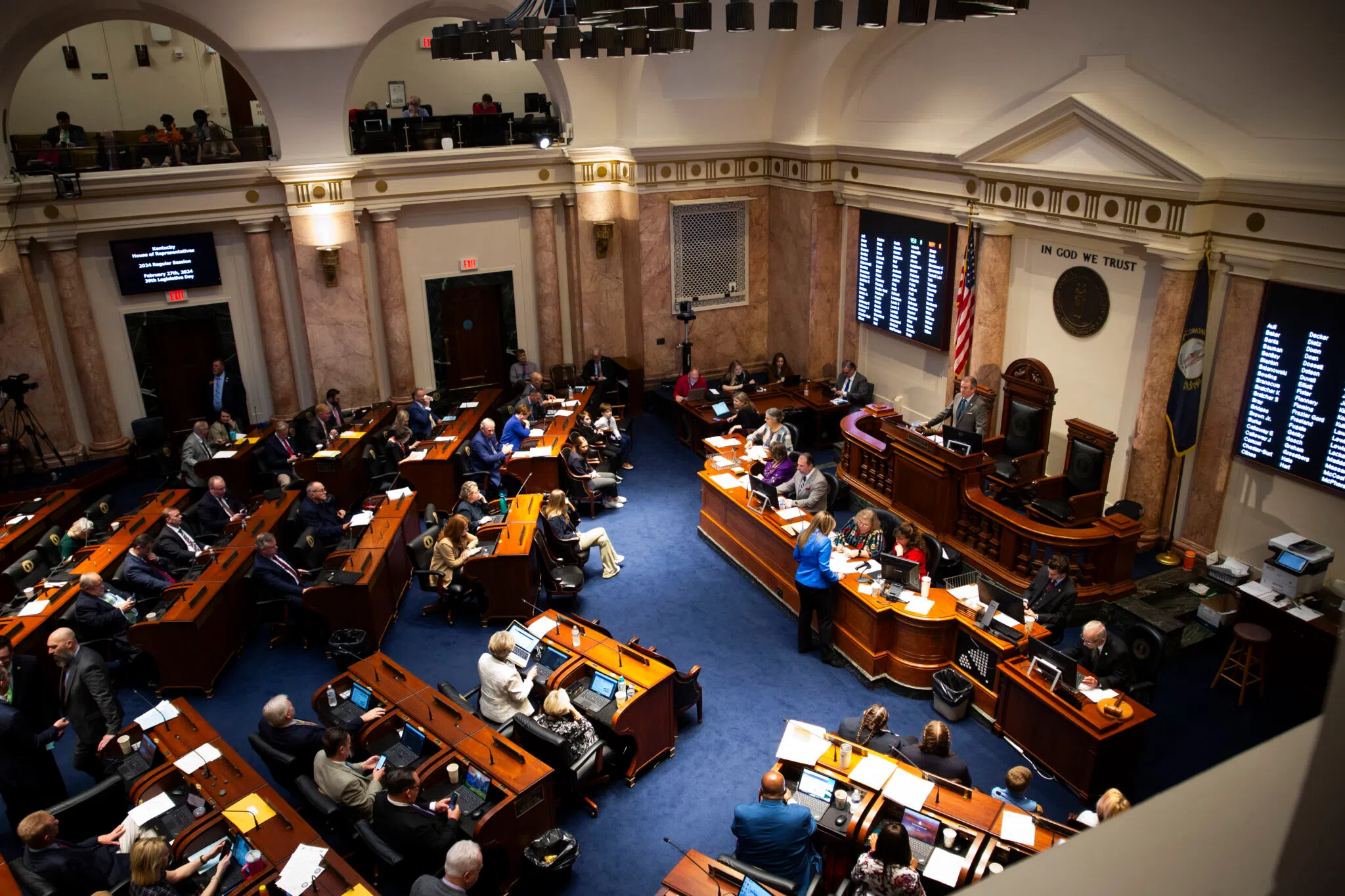

On Tuesday, Feb. 4, House Bill 1 — the bill that would lower the income tax from 4 percent to 3.5 percent on Jan. 2, 2026 — passed the Kentucky Senate by a 34-3 margin with four Democrats joining the Republican supermajority that voted in favor of the legislation. According to the fiscal note attached to the bill, the change will reduce state revenue by an estimated $718 million.

Democratic senator Cassie Chambers Armstrong, who voted against the bill, said she was worried about decreasing the income tax.

“I…worry about cutting our revenues at a time of such economic uncertainty. We don’t know what tariffs, if any, might be coming. We don’t know what federal funds, if any, might be going away,” Chambers Armstrong said to Kentucky Lantern reporters on Tuesday.

This half-a-percentage point decrease is just the latest step on the Republican supermajority’s path to reduce the tax to zero. They reduced the rate from 5 percent to 4.5 percent in 2022 and another half a percentage point in 2023.

The Legislative Research Commission reports that House Bill 1 was signed by Democratic Governor Andy Beshear on Feb. 6. He had previously said the commonwealth could handle the income tax reduction.

“I believe with our booming economy that the next income tax cut is something we can do and still provide the services that are out there,” the governor said.